Livermore Real Estate: Should I buy a home right now?

While we are being bombarded with news of higher interest rates, an impending recession, and a real estate market slowdown….it is important to focus on the facts and the big picture.

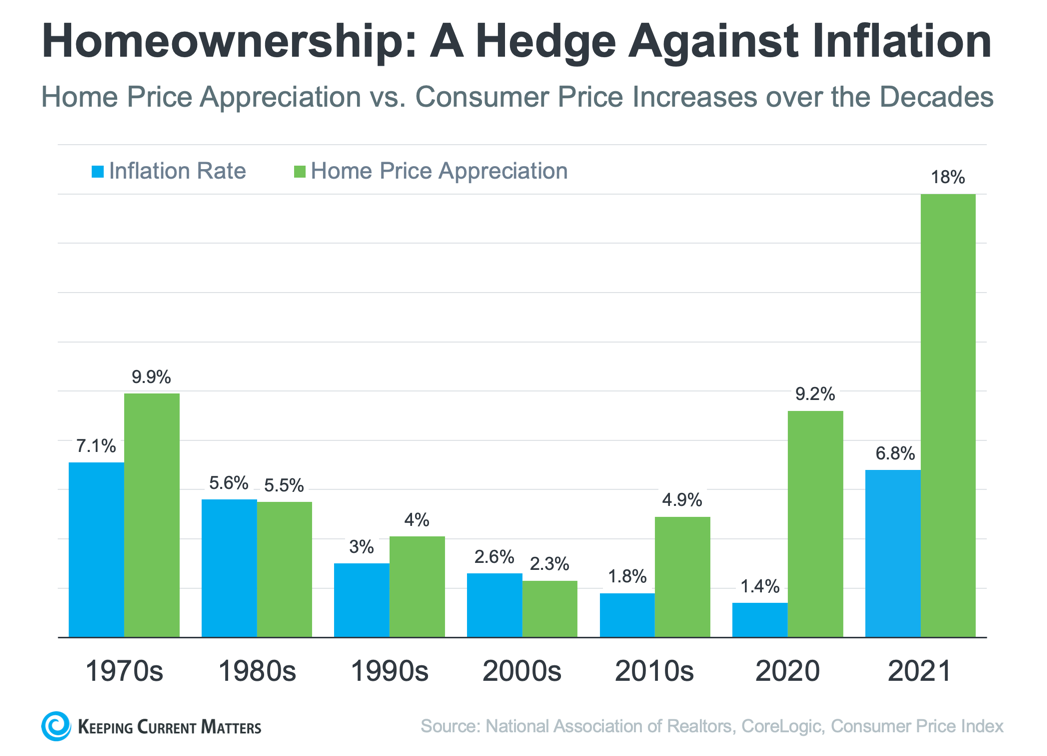

Yes, interest rates are higher and will likely rise again soon. There is no doubt this is one of the greatest factors impacting buyer confidence at the moment. But if you were planning to buy before rising rates, you should stay the course with your dream of homeownership. Focus on the fact that historically homeownership outperforms inflation. So if there’s any asset to invest in at the moment, a home will hold its value better than most tangible assets.

TIP #1: Do your homework, shop rates, talk to and work with a lender you feel most comfortable with.

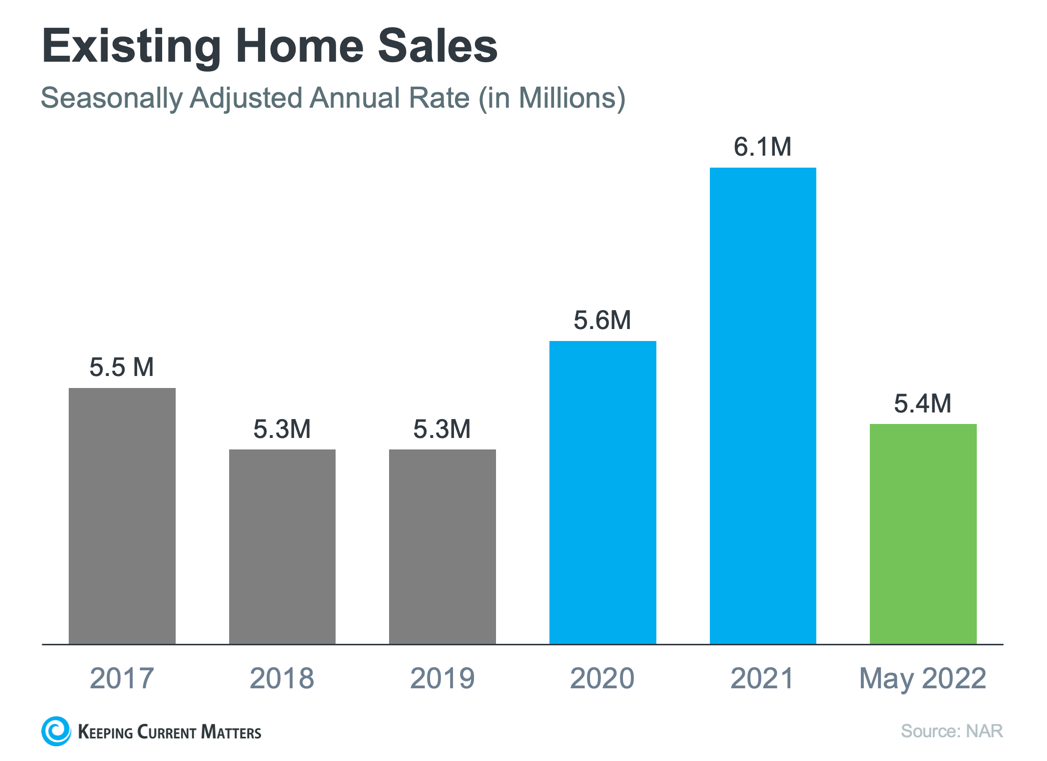

Yes, we are experiencing a slowdown in the Livermore Real Estate Market. Inventory is rising just a bit, caused by less buyers competing for homes and some homes sitting on the market for longer. Today’s market is beginning to look a lot like our pre-pandemic market where buyers had more negotiating power.

TIP #2: Ask your Realtor to provide you with regular comps for the neighborhood you are looking to buy in. Play close attention to days on market and price reductions before crafting a smart and winning offer.

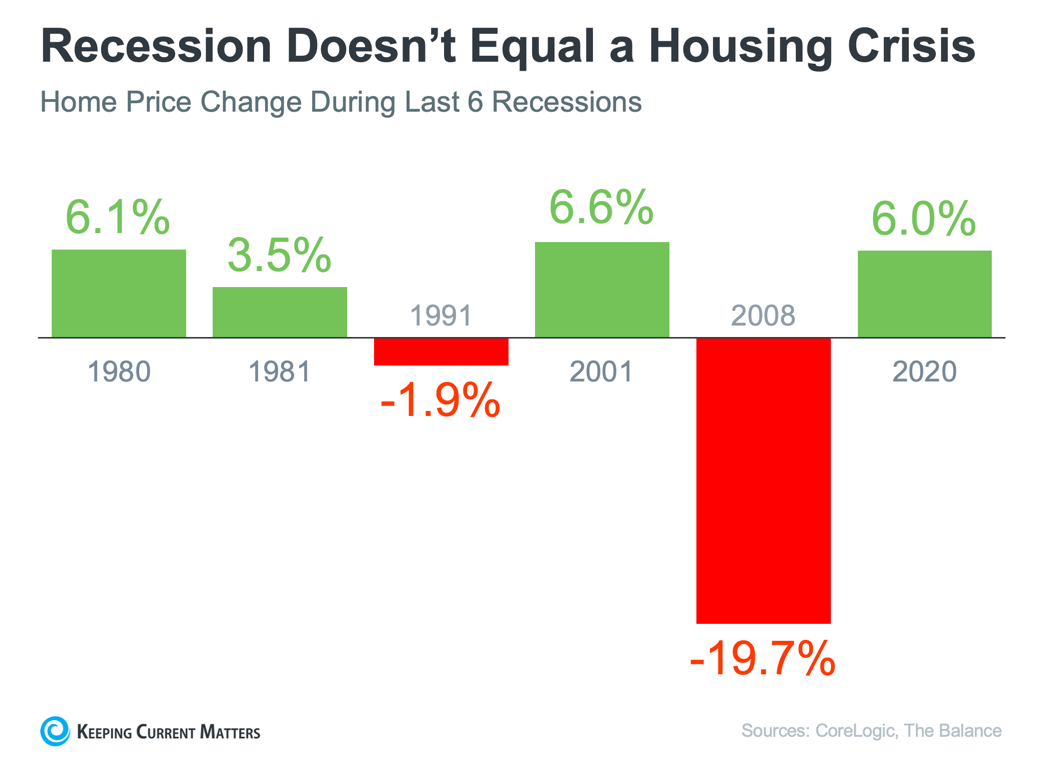

Yes, there is a possibility of an impending recession. But instead of worrying about the future, focus on the fact that home prices continued to appreciate in 4 out of the last 6 recessions. So, if a recession happens, it does not necessarily mean home prices will decline.

TIP #3: Don’t stress over things you can’t control. Lean into your RIGHT NOW…and make your everyday lifestyle one you find joy in.

So…should you buy a home right now?

Yes. Homeownership is a good investment. Fannie Mae, Freddie Mac, CoreLogic, and the National Association of Realtors all predict home prices to rise between 8-10% in 2022. Appreciation will continue, even if it is at a slower rate than the last 2 years. Homeowners are projected to grow their wealth by a minimum of $100k over the next 5 years based solely on the increased home equity they will gain.